Why on the earth I'm writing on debit and credit?

There were couple of requests from my friends to write a summarized article on this topic. Most of the accounting job interviews contains at least few questions on debit and credit.

There are thousands of articles in internet on debit and credit. But I thought I should write a summary version customized to Sri Lankan interviews, so that it could be useful for someone who do not have much time to prepare for an interview.

(picture credit - http://jobsearchnow.net)

Since there are much detailed articles already in the net, I've taken most of the below examples directly from some sites and the relevant link is given under each quoted paragraphs. Please refer to those separate sites for explanations and more details. But if you already know your theory and just need a revision, this article is sufficient.

There are thousands of articles in internet on debit and credit. But I thought I should write a summary version customized to Sri Lankan interviews, so that it could be useful for someone who do not have much time to prepare for an interview.

(picture credit - http://jobsearchnow.net)

Since there are much detailed articles already in the net, I've taken most of the below examples directly from some sites and the relevant link is given under each quoted paragraphs. Please refer to those separate sites for explanations and more details. But if you already know your theory and just need a revision, this article is sufficient.

Which Accounting standards use in Sri Lanka?

Sri Lankan Accounting Standards should be used and it is almost inline with International Accounting standards.

(Ref for more details -

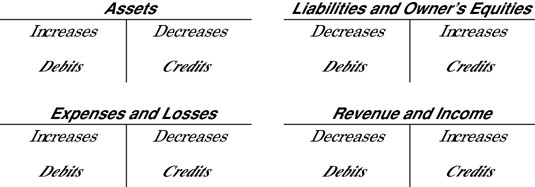

What are the basic concepts of debit and credit?

(Obtained from the site http://www.dummies.com/how-to/content/knowing-your-debits-from-your-credits.html)

Some examples for debit and credit

1. The owner brings cash from his personal account into the business (Capital)

Dr Cash

Cr Capital

2. Office supplies are purchased on credit( Expenses)

Dr Office Supplies

Cr Accounts Payable

3. Wages payable are paid (Liabilities)

Dr Wages Payable

Cr Cash

4. Revenue is earned but not yet received (Revenue)

Dr Accounts Receivable

Cr Revenue

(Ref http://accountingexplained.com/financial/introduction/debit-credit-rules)

5. Gain on disposal of assets (Assets)

Assume that in the above example the sale proceeds were only $100,000. The carrying amount at the date of disposal was $200,000 so there is a loss of $100,000 since carrying amount exceeds sale proceeds.

The following journal entry is passed to record loss on disposal.

Assume that in the above example the sale proceeds were only $100,000. The carrying amount at the date of disposal was $200,000 so there is a loss of $100,000 since carrying amount exceeds sale proceeds.

The following journal entry is passed to record loss on disposal.

| Dr Accumulated Depreciation | 1,800,000 | |

| Dr Cash | 100,000 | |

| Cr Loss of Disposal | 100,000 | |

| Cr Equipment | 2,000,000 |

(Ref http://accountingexplained.com/financial/non-current-assets/disposal-of-fixed-assets)

6. Raw materials purchased, Raw materials moved in to WIP and then goods are completed - initial book keeping entries for inventory (Inventory)

| Debit | Credit | |

| Raw Materials Inventory | $100.00 | |

| Accounts Payable | $100.00 | |

| Debit | Credit | |

| Work in Process Inventory | $100.00 | |

| Raw Material Inventory | $100.00 | |

| Debit | Credit | |

| Finished Goods Inventory | $100.00 | |

| Work in Process Inventory | $100.00 |

(Ref - http://bizfinance.about.com/od/Examples-Bookkeeping-Entries/a/Example-Of-A-Bookkeeping-Entry-For-An-Inventory-Transaction.htm)

7. Selling inventory for cash (Inventory)

| Debit | Credit | |

| Cost of Goods Sold | $100.00 | |

| Finished Goods Inventory | $100.00 | |

| Debit | Credit | |

| Cash | $100.00 | |

| Sales | $100.00 |

(Ref - http://bizfinance.about.com/od/Examples-Bookkeeping-Entries/a/Example-Of-Bookkeeping-Entry-Selling-Inventory-For-Cash.htm)

8. Recording of Income tax expense (Income tax)

Dr Income tax expense

Cr Income tax liability

9. Recording the Issue of shares (financial instruments)

Dr Bank

Cr Share capital

Cr Share premium

9. Recording the Bonus issue (financial instruments)

Dr Share premium

Cr Share capital

10. Acquisition of an asset using a capital lease -Lessee (Leases)

Dr Fixed assets

Cr Lease obligation

Dr Depreciation expense

Cr Accumulated depreciation

11. Paying capital lease payments - Lessee (Leases)

Dr Lease obligation

Dr Interest expense

Cr Cash

Its hard to write all possible entries in one sheet. But you should be able to get some idea along with the examples above. I will keep adding more entries as and when I get time.

Good luck :)

Good luck :)

List of international financial reporting standards

Please go through below link and at least have a basic idea what the existing standards are.

http://en.wikipedia.org/wiki/List_of_International_Financial_Reporting_Standards

Anyone interested in trying your knowledge before the interview?

Do the below quiz.

http://www.accountingcoach.com/online-accounting-course/07Dpg01.html

Conclusion note to interviewers

If I interview someone, I would never ask "what is the double entry for this particular transaction". But many interviewers in Sri Lanka do so. "Any good accountant knows the accounting standards by heart", one of my former bosses once argued with me on this. I agreed with him. But I told him, "its not vice versa sir" ! Everyone who can memorize and repeat a whole damn standard is not a good accountant. Therefore put some equal weightage to other important characteristics of a person when you recruit. Debit, credit can be taught. Standards can be referred to books. But its hard to change a person, his attitudes and values.

p.s - Accounting experts out there - Apologies if there's any mistakes. You are most welcome to correct it :)

p.s - Accounting experts out there - Apologies if there's any mistakes. You are most welcome to correct it :)

3 comments:

Những hieu biet khi mang thai sẽ giúp các mẹ có hành trang khi chuẩn bị làm mẹ, bà̀ bầu uống mật ong được không là điều mà nhiều chị em thắc mắc vì mật ong rất có lợi cho sức khỏe nhưng đối với bà bầu thì sao, những bệnh nguy hiểm đối với bà bầu là những bệnh gì, nó có thể nguy hiểm đối với thai nhi hay không, bà bầu bị động kinh có nguy hiểm không vì bệnh động kinh là bệnh hiếm gặp ở phụ nữ mang thai, nhưng nếu bị thì sẽ ảnh hưởng không nhỏ tới thai nhi, những loại nước tốt cho bà bầu là những loại nào, và việc bổ sung nước có lợi ích gì cho bà bầu không. những loại trái cây tốt cho bà bầu là những loại nào, và đặc biệt những loại này phải tốt cho cả thai nhi nữa

I suppose this info is completely unique.Accountants in Toronto

The blog is good enough, keep up writing such type of posts.

Accounting Firms in Toronto

Post a Comment